Making Hay in the Housing Crisis

Even though our economy is problematic and any industry struggles to grow, investors need to be poised to profit from emerging business trends. We are going to have to do this in order to generate top notch returns for clients. Can we capitalize on these trends within our managed portfolios?

One verifiable condition to examine is the brewing housing shortage. Back in 2008, the financial crisis crimped homebuilding and since then construction of new homes has been recovering at a snail’s pace. Builders have been exceedingly cautious and mortgage financing standards have been stiff. The upshot is today’s housing market does not provide for new household formation or the demand for single and multifamily homes.

New home construction units averaged 1.788 million between 2002 and 2007. We are only creeping along at a 1.1 million rate currently according to the US Census Bureau.

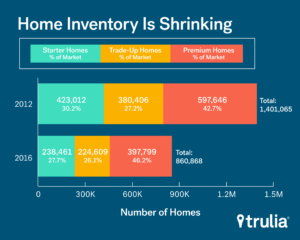

Most major metropolitan areas have reported housing shortages particularly for entry level or low income housing. According to real estate search engine, Trulia, the number of starter homes inventory is down 40% since 2012. This reflects strong housing markets as buyers have snapped up the available inventory.

In our Portland Metro area, the total inventory fell from 2526 units in Q1 2012 to 732 units in Q1 2016. This is a paltry supply of homes and comes woefully short from meeting the demand. Many other markets across the country are similar.

The National Low Income Housing Coalition reports only 31 affordable rental units for every 100 low income households. The market for rental availability is also undersupplied.

There is a possibility of this changing. If homebuilders are more confident in demand, they may begin to initiate more permits. Cities with more acute problems may expand urban growth boundaries to enhance the housing supply.

Interest rates have dropped over the past month. If mortgage rates were to follow, it could touch off another rush of refinancing amongst existing homeowners. Lower mortgage rates make home ownership more affordable and help first time buyers qualify for loans.

There will certainly be winners in the stock market from expanding construction activity. Certainly, the actual large scale home builders like DR Horton, Lennar, and Pulte would be considered.

Other beneficiaries of the trend are material suppliers like Sherwin Williams and Mohawk as well as the box retailers like Home Depot and Lows.

A free market economy that can function properly can move to solve problems like inadequate housing supply. A good marketplace has robust demand. Investors provide financing to suppliers in the form of capital and through this process, production increases to meet demand. As investors, we want to look for these opportunities to materialize.

My hope is that the housing crisis can be ameliorated and share prices of these providers get a boost.

Leave a Reply

You must be logged in to post a comment.